For details on option pricing using trees see Cox, John C., Stephen A. Ross, and Mark Rubinstein. "Option pricing: A simplified approach." Journal of financial Economics 7.3 (1979): 229-263. For introduction to different type of options see

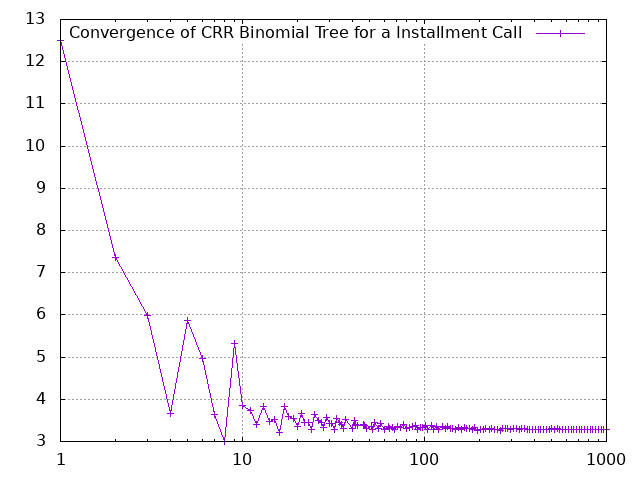

Option price = 3.282481 (1000 timesteps / time 0.077095 secs)

crr (at) neurolab (dot) de